The loan carries a fixed rate of 445 which consists of 054 lenders margin ie. Break costs are fees charged by lenders when you make extra repayments on a fixed-rate home loan.

Fixed Rate Home Loan Home Loans

You will need to pay us a fixed rate break cost of approximately 230870.

. The bank quotes the break cost as 148000. Why do we charge break costs. To demonstrate this imagine a customer has a five-year fixed rate loan of 400000 paying a 5.

We do this so we can manage the risk of interest rate changes and lock in our own funding costs. Why do we charge break costs. This fee is designed to compensate the financial institution for any loss of profit it faces as a result of a customer breaking the terms of the contract including administration and its own wholesale.

If some explanation was given it did not adequately describe the manner in which the break cost would be calculated. Inform them that a break cost would be charged if they terminated their loan before the expiry of the fixed rate period. If you would like an estimate of your break cost please call us on 1800 007 722 61 2 8245 4383.

When you decide to fix your loan interest rate we enter into a contract with you to fix the interest rate for your loan for a specified period. This loss is passed onto you as a Break Cost. We accept that a financial firm may suffer financial loss if a fixed rate.

If the customer discharges the loan prior to maturity after interest rates. If you break your fixed rate term we are still required to pay our commitment in the wholesale market for the remaining term. Your fixed rate loan exceeds the cost of funds at the time of repayment resulting in a loss to NAB.

Own funding position on the assumption that they will receive those payments. Each bank uses a different formula to work out its break costs so its worth finding out how your lender calculates this fee. When we agree to lend money to you for a fixed period at a fixed rate we may enter into finance arrangements to assist us to provide your fixed rate.

Home loan break costs are a fee that a lender will charge a borrower if they want to end or exit their fixed-rate loan before the end of the term specified on the contract. As a result if you make certain changes to your loan it will change that. To enable us to fund your loan we.

What are fixed rate break costs. With fixed interest rate loans who say that the financial firm did not. They are often calculated on a sliding scale such as a percentage of the outstanding principal at the.

If you go over this amount or pay off the loan entirely then you will be. This exemption however does not apply to Personal. Why do we charge break costs.

391 exclusive of margin. When you seek to break a fixed rate mortgage early the breakage cost cant be more than the difference between the rate the bank was able to borrow money at for the original term in the inter-bank markets minus what they can get for depositing the money in the inter-bank markets for the. These charges allow the lender to recoup the cost of the interest rate associated with fixed-rate funding.

If interest rates fall and borrowers decide to repay a fixed rate loan the bank will require the customer to pay a break funding fee sometimes called an early termination interest adjustment. Usually the Lender arranges their. Keep in mind break costs are different to early exit fees and discharge fees.

When a Lender lends you money at a fixed interest rate they do so on the understanding that you will make certain fixed payments for the whole of the fixed rate period. As an example a customer may ask the bank for a break cost quotation on his fixed rate loan which has 500000 maturing in January 2026. However if the margin was excluded the break cost would be.

Banks manage the interest rate risk on their fixed rate loan book by locking in similar term liabilities. Most lenders will allow you to pay a small amount off of your mortgage each year without being charged. Break cost loan x interest rate change x time left on the loan.

What is a Break Cost. Breakage costs may refer to either a prepayment penalty on a fixed-rate loan or a fee that a lender charges to keep the borrower from refinancing a loan shortly after closing. If you repay some or all of the fixed rate loan account early or switch to another product we may incur costs from terminating these finance arrangements commonly known as break costs which we will.

When we agree to lend you money at a fixed interest rate we obtain money from the money market at wholesale interest rates based on you making your payments as agreed until the end of the. When we agree to lend you money at a fixed interest rate we obtain money from the money market at wholesale interest rates based on you making your payments as agreed until the end of the. A break cost is a fee that represents our loss if you repay your loan early or switch your product interest rate or payment type during a fixed rate period.

Here is a break cost calculator. A break cost is a fee that represents our loss if you repay your loan early or switch your product interest rate or payment type during a fixed rate period. Early repayment adjustmentBreak feeEarly exit fee the expensive one A discharge feeearly repayment fee usually a couple of.

Understanding Fixed Rate breakage costs Updated May 2019 Summary. You prepay all of the total amount owing on your loan before the end of the fixed rate period. Fixed rate break costs.

There are two fees to pay when you break a fixed home loan. The break cost or break fee of a loan is a fee some lenders may charge people who want to end their fixed-rate home loan before the end of the fixed-rate term in the contract. Lenders do this to compensate for any financial losses they will incur as a result of you breaking your fixed-rate home loan early.

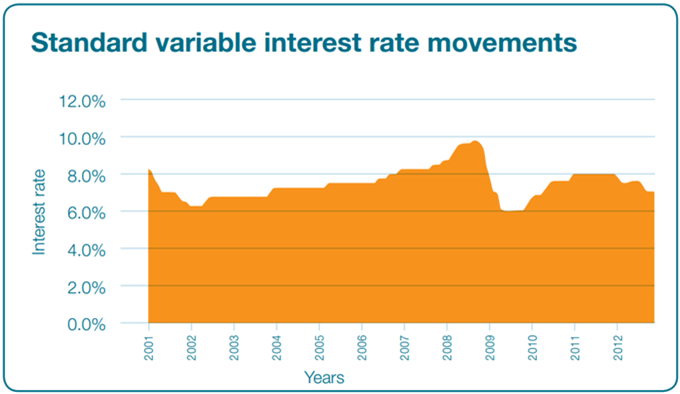

No economic cost will be charged on home loans when you make a partial prepayment andor increase your repayments as long as these extra payments do not exceed 20000 within the fixed rate term. If the four year wholesale interest rate in April 2010 is 500 pa. The table below shows examples of the fixed rate break costs if there are 4 3 2 and 1 years left on your fixed rate period based on loan details in the above paragraphs.

For example lets say you had a fixed-rate home loan for 5 years. When you take out a fixed rate home loan we lock in our funding costs at a fixed rate in the wholesale money market for the same term on the same day. Years remaining on fixed rate.

When we agree to lend you money at a fixed interest rate we obtain money from the money market at wholesale interest rates based on you making your payments as agreed until the end of the. A home loan break cost is a fee charged by a lender to a borrower if the borrower breaks the fixed rate term in their home loan prior to its completion or if they make extra repayments above their maximum allowed amount. A break cost is a fee that represents our loss if you repay your loan early or switch your product interest rate or payment type during a fixed rate period.

A Break Cost is the calculated amount of the loss which we suffer if you choose to break your fixed interest rate loan contract with us. Fixed rate break costs can be substantial cant be forecasted and change from day to day. Break costs ARE payable on your fixed interest rate loan when wholesale interest rates have fallen during the fixed rate period on your loan AND.

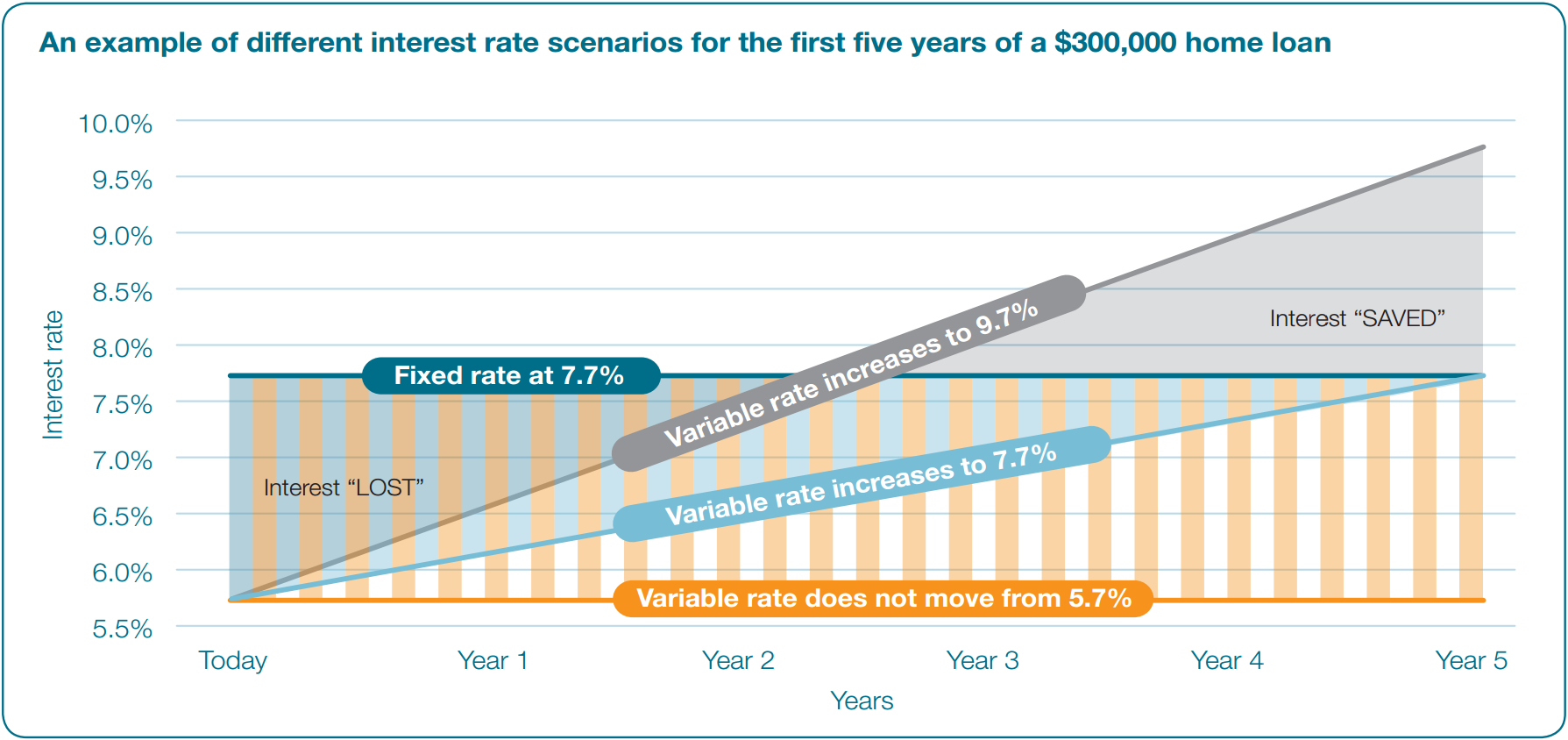

Fixed Vs Variable Home Loans 2021 Mortgage Choice

Breaking Your Fixed Rate Home Loan Westpac Nz

What S The Penalty If I Break My Mortgage With Cibc Ratehub Ca

How Much Will It Cost To Break My Mortgage With Td Bank Ratehub Ca

How Much A 200 000 Mortgage Will Cost You

How Much Will It Cost To Break My Mortgage With Td Bank Ratehub Ca

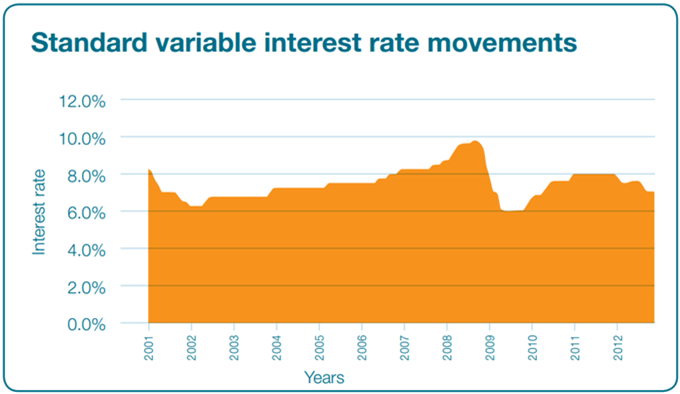

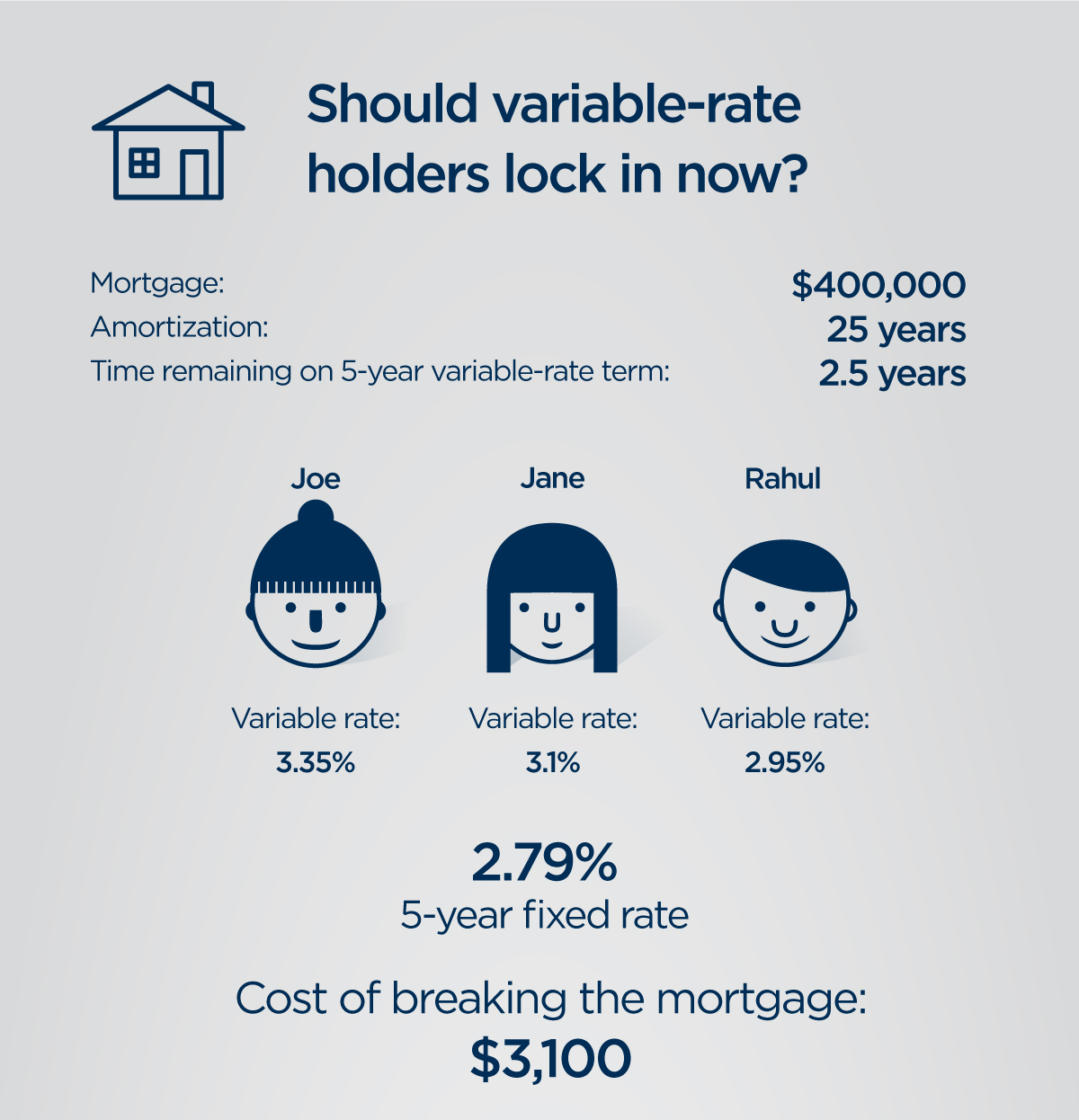

Even With Fixed Mortgage Rates Lower Than Variable Ones Locking In Isn T A Slam Dunk National Globalnews Ca

Fixed Rate Loans And Break Costs Break Cost Calculator Uno

What S The Penalty If I Break My Mortgage With Scotiabank Ratehub Ca

Mortgage Break Fee Calculator Interest Co Nz

Variable Vs Fixed Interest Rates For Student Loans College Ave

How Much Of Your Home Loan Repayments Are Interest Mortgage Choice

Loan Against Fd Fixed Deposit Overdraft Against Fd 2021

What Should You Do When The Fixed Rate Term Ends Your Mortgage Australia

Thinking Of Breaking A Fixed Rate Contract Here S What You Should Know Your Mortgage Australia

0 comments:

Post a Comment