The Retail Direct platform will allow retail investors to directly buy and sell government debt securities such as central government debt state loans. This account can be opened by filling up the online form using the OTP received in the registered mobile number and e-mail.

Retail Direct Scheme Meaning Eligibility How To Open Retail Direct Gilt Account Fees And Charges

About the RBI Retail Direct scheme.

RBI Retail Direct Scheme. Under the scheme retail investors Retail Investors individuals non-professional investor who buys and sells securities or funds that contain a basket of securities such as mutual funds and Exchange Traded Funds ETFs will have the facility to open and maintain the Retail Direct Gilt Account Gilt account is debited or credited with treasury bills or. A circular from the Reserve Bank of India said that it would. Under this scheme the retail investors will be able to open and maintain their glit securities account named as Retail Direct Glit Account or simply RDG Account via an online portal with RBI.

Under the scheme retail investors individuals will have the facility to open and maintain the Retail Direct Gilt Account RDG Account with RBI. Investors will be able to easily open and maintain their government securities account online with the RBI. In February 2021 proposed to allow retail investors to open gilt accounts with the central bank to invest in Government securities directly and without the.

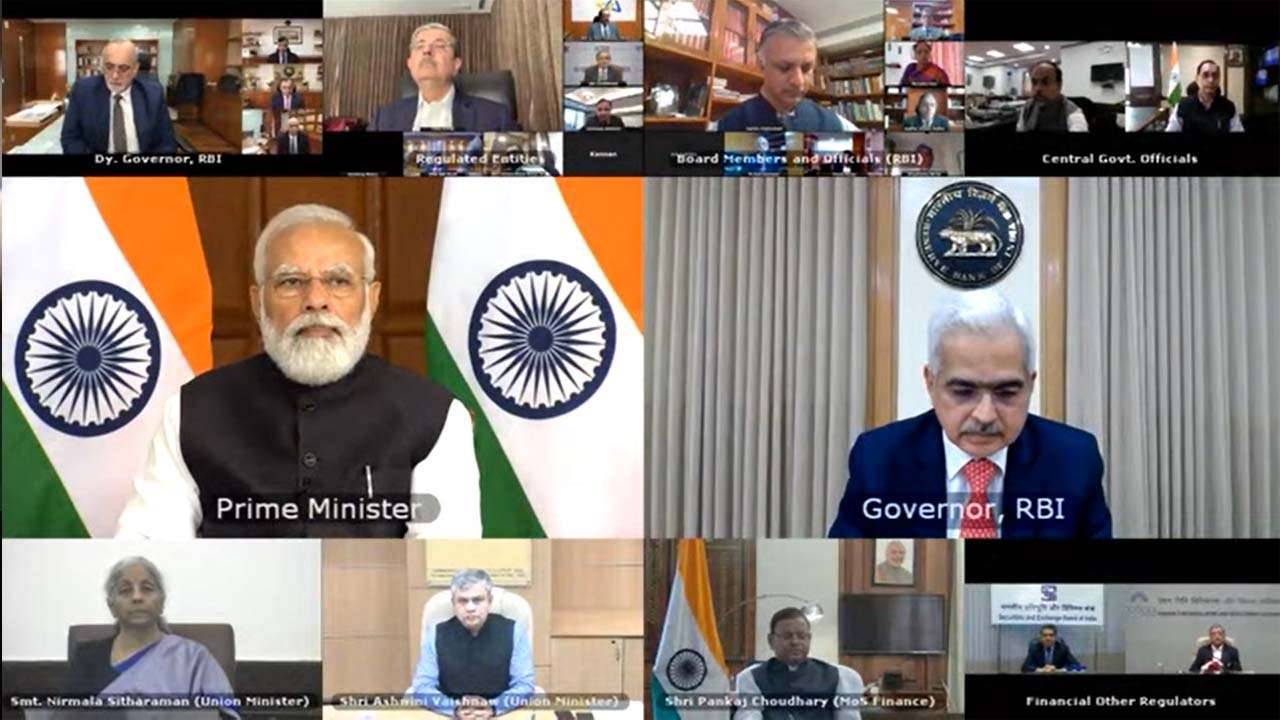

The Reserve Bank of India RBI launched the Retail Direct Scheme on 12th July 2021. RBI Retail Direct Scheme announced by the RBI is a one-stop solution to facilitate investment in government securities by individual investors. 2 days agoPrime Minister Narendra Modi will launch the so-called RBI Retail Direct Scheme for investors on Friday the Reserve Bank of India said in a media invite.

These accounts can be. It was launched in virtual mode by Prime Minister Narendra Modi. Get more Personal Finance News and Business News on Zee Business.

As per the scheme investors will be able to directly invest in government securities. Context PM to launch RBIs retail direct integrated ombudsman schemes. 2 days agoRBI Retail Direct Scheme will enable retail investors to invest in government securities.

Retail investors can open and maintain their government securities account with the RBI free of cost it said. A Government Security G-Sec is a tradable instrument issued by the Central Government or the State Governments. The opening and maintaining of these government securities accounts will be free of cost.

Scope of the Scheme. 8 hours agoHow Does The RBI Retail Direct Scheme Work. 2 days agoThe RBI Retail Direct scheme is a one-stop solution to facilitate investment in Government Securities by individual investors.

1 day agoPrime Minister Narendra Modi will launch the RBI Retail Direct Scheme on Friday to allow retail investors to invest easily in government securities. RBI Retail Direct Scheme. 6 hours agoNew Delhi.

A significant milestone in the development of the Government securities G-sec market the Reserve Bank of India-Retail Direct RBI-RD Scheme will bring G-secs within easy. 10 hours agoThe RBI Retail Direct Scheme is aimed at enhancing access to the government securities market for retail investors. 14 hours agoThe RBI Retail Direct Scheme is aimed at enhancing access to government securities market for retail investors.

RBI Governor Shaktikanta Das had first flagged this initiative in a February policy review while calling it a major structural reform. The Reserve Bank of India RBI today announced the activation of the RBI Retail Direct Scheme. RBI Retail Direct Scheme will allow retail investors to directly invest in Government Securities G-secs by opening Gilt Accounts.

Prime Minister Narendra Modi will launch two innovative customer-centric initiatives of the Reserve Bank of India RBI the retail direct scheme and the integrated ombudsman scheme via video-conferencing. During the event Union Finance Minister Nirmala Sitharaman and Reserve Bank of India Governor Shaktikanta Das were present along with the Prime Minister. 14 hours agoThe retail direct scheme offered by RBI is a good opportunity for retail investors to invest in government securities sovereign bonds etc.

It offers them a new avenue for directly investing in securities issued by the Government of India and the State Governments. The scheme will also support investment in Government Securities G-Sec by retail investors. It offers them a new avenue for directly investing in securities issued by the Government of India and the State Governments.

6 hours agoEarlier in the day the RBI Retail Direct Scheme was launched in virtual mode by Prime Minister Narendra Modi. Retail Direct scheme is a one-stop solution to facilitate investment in Government Securities by Individual Investors. I Open and maintain a Retail Direct Gilt Account RDG Account ii Access to.

PM Modi said that the schemes launched today will. RBI Retail Direct is a comprehensive scheme which provides the following facilities to retail investors in government securities market through an online portal. RBI Retail Direct is a comprehensive scheme which provides the following facilities to retail investors in government securities market through an online portal.

Open and maintain a Retail Direct Gilt Account RDG Account Access to primary issuance of. It offers retail investors a new avenue for directly investing in the securities. The Reserve Bank of India launched the RBI Retail Direct Scheme.

Prime Minister Narendra Modi on November 12 Friday is all set to launch the RBI Retail. 6 hours agoAs per the scheme retail investors individuals will have the facility to open an online Retail Direct Gilt Account RDG Account with the Reserve Bank of India RBI. 9 hours agoThe RBI Retail Direct Scheme is aimed at enhancing access to government securities G-sec market for retail investors.

13 hours agoThe RBI Retail Direct Scheme is aimed at enhancing access to government securities market for retail investors. 13 hours agoThe RBI Retail Direct Scheme is aimed at enhancing access to the government securities market for retail investors the Prime Ministers Office PMO. It is the first time in India when retail investors will have an option of simple and direct channel for investment in government securities.

Retail Direct Scheme RBI. A significant milestone in the development of the government securities G-sec market the Reserve Bank of India-Retail Direct RBI-RD Scheme will bring G-secs within easy reach of the common man by simplifying the process of. The scheme offers retail investors.

11 hours agoWith the RBI Retail Direct Scheme small investors in the country have got a safe medium of investment in government securities Modi added.

Pm Modi Launches Rbi S Retail Direct Gilt Investment Scheme The Economic Times

Rbi Retail Direct Scheme India Is Opening Its 1 1 Trillion Bond Market To Retail Buyers Business News The Indian Express

Rbi Retail Direct Central Bank S New Scheme Offers Direct Access To Government Bonds

Rbi Lifts Business Restrictions Imposed On Diners Club International Business News

Rbi Introduced Rbi Retail Direct Scheme To Facilitate Investment In G Sec By Individuals

Rbi Issues Scheme To Market Govt Securities To Retail Investors

Rbi Retail Direct Scheme Individuals Can Now Directly Buy T Bills G Secs From Market The Financial Express

0 comments:

Post a Comment